234. The United States Borrowed Extensively During the Great War

Description

This section is from the "Outlines of Public Finance" book, by Merlin Harold Hunter. Amazon: Outlines of Public Finance.

234. The United States Borrowed Extensively During the Great War

In spite of the strenuous efforts to secure revenue from taxes, it was found necessary to secure the larger part of the needed funds by borrowing. The different loans were well organized and were carried through very successfully. The existence of the Federal Reserve banking system proved of inestimable worth. The Federal Reserve Act provides that these banks could be made to act as fiscal agents of the government, and the Secretary of the Treasury was not slow in enlisting their services. Each of the twelve reserve banks acted as centers and were responsible for making the loan projects successful. These banks and their members, as well as the other banking institutions, were enthusiastic agents of the government in taking subscriptions for the loans, and were large purchasers of the bonds themselves. The advance of money and credit which they continually made to the government was another valuable service.

Bond Issues. - Five issues of bonds were floated, and the success of each issue left nothing to be desired. Strong appeal was made, both to patriotic and economic sentiment, and the pressure exerted at times was so strong that subscription became more nearly coercive than voluntary. Wide publicity was given through newspaper, magazine, and poster advertising, as well as through short speeches at moving picture theaters, churches, and other public gatherings. Various organizations throughout the country took up the burden of enlightening the public and securing subscriptions to the bonds. The issues were made in convenient denominations, the fifty dollar "baby bond" being especially designed to attract the small investor. The privilege of paying for the bonds on the installment plan was a further aid in securing subscriptions.

Treasury Certificates. - In anticipation of the return from the various loans and taxes, an extensive use was made of the treasury certificates. These were carried very largely by the banks, and were canceled when the anticipated revenue was realized. By this process the government did not have to wait for funds, but was financed from the credit which banks could extend, and a large part of the expected revenue was actually spent before it was received. The total amount of these certificates of indebtedness exceeded the returns from the loans. The sale of war savings certificates and thrift stamps was inaugurated to appeal to the class of savers who could not purchase bonds, and incidentally to secure some additional revenue from those who had made bond purchases. The post office was used extensively as the agent for these sales.

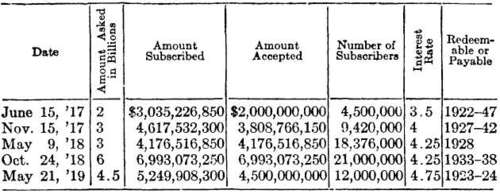

Success of Loan Policy. - This brief outline of our loan policy cannot but bring into contrast the effectiveness of the methods employed as compared with those used in attempting to secure loans at the time of the Civil War. The possibility of employing private agencies was seized eagerly, and every possible means was used to create a desire for the securities. Recognition was made of the fact that, in order for the public to buy, they must either be supplied with what they want, or be made to want what is supplied. Not only were the bonds made attractive, but every effort was made to create desire for them. Even the titles - Liberty Loan to each of the first four issues, and Victory Loan to the fifth - indicate that a psychological appeal was intended. Some of the variations in the bonds, together with the success of the issues, is indicated in the following table:1

1 This table is given in practically this form by E. L. Bogart, in his study Direct and Indirect Costs of the Great World War, under the aiispices of the Carnegie Endowment for International Peace. A more elaborate table could be compiled which would show the tax exemptions of the different issues, the conversion privileges, etc.

Continue to: