Domestic Branches Of Federal Reserve Banks

Description

This section is from the book "Banking Principles And Practice", by Ray B. Westerfield. Also available from Amazon: Banking principles and practice.

Domestic Branches Of Federal Reserve Banks

The Federal Reserve Act, as amended June 21, 1917, provides that the board may permit or compel a federal reserve bank to establish branches within its district or within the district of any reserve bank which may have been suspended. Such branches, subject to such rules and regulations as the Federal Reserve Board may prescribe, are operated under the supervision of a board of directors, consisting of not more than seven nor less than three members of whom a majority of one are appointed by the federal reserve bank of the district, and the remaining directors by the Federal Reserve Board.

The volume of business done by a branch may sometimes equal or even exceed that of the parent bank. The establishment of branches makes it possible for the board to appease local jealousy against a federal reserve city and to bring the facilities of the reserve bank nearer the member banks, such proximity being particularly desirable in the larger western districts. The board has also found it advisable to establish branches for the purpose of specially catering to the state banks and inducing them to join the federal collection system.

Under the authority of the board branches have been established as follows:

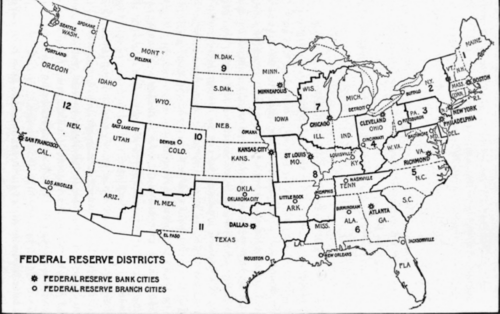

Figure 4. The Federal Reserve Districts

District No. 1 2. 3 4. 5 6. 7 8. 9 10 11 12

Federal Reserve City

Boston

New York

Philadelphia

Cleveland

Richmond

Atlanta

Chicago

St. Louis

Minneapolis

Kansas City

Dallas

San Francisco

Branches

None

Buffalo

None

Pittsburgh, Cincinnati

Baltimore

New Orleans, Jacksonville, Birmingham,

Nashville Detroit

Louisville, Memphis, Little Rock Helena

Omaha, Denver, Oklahoma City El Paso, Houston Seattle, Portland, Spokane, Salt Lake City, Los Angeles

In addition to their branches the reserve banks establish temporary or permanent agencies in such cities in their districts as may require special services, such as collecting checks or making loans on warehouse receipts. The St. Louis reserve bank, for instance, established such an agency in Memphis in 1915 as a convenience to the banks of that area in handling cotton rediscount paper. Such agencies are less expensive to operate than branches with their completely equipped offices, vaults, and full staff of officers; moreover an agency is usually the forerunner of a branch to be opened when the volume of business warrants the expense.

Two types of organization exist among the branches. The older, like the New Orleans branch, has a definite area allotted to it; the capital subscriptions by the member banks of this area are regarded as the theoretical capital of the branch, upon which its earnings are estimated; and the members within that area are required to deal with the branch. The later type, like the Spokane branch, has no definite area or capital assigned to it, but is regarded rather as an office of the reserve bank; members are not required to deal solely with this branch. A collection zone is allotted to each branch, and checks drawn upon banks in this zone may be sent to the branch by any member bank, thus saving time in transit and reducing the float. The resulting credit is reported by the branch to the parent bank. Member banks send their collections either to the parent or to the branch. They send their offerings for discount, however, to the parent bank, but upon application a member who is in the allotted collection zone may send discount offerings to the branch. Daily reports of each member's account are forwarded to the parent by the branch.1

1 See Federal Reserve Bulletin, Aug. 1917. P. 586.

Continue to: