Chapter III. Capital Stock: Shareholders' Rights And Liabilities

Description

This section is from the book "The ABC Of Banks And Banking", by George M. Coffin. Also available from Amazon: The ABC of Banks and Banking.

Chapter III. Capital Stock: Shareholders' Rights And Liabilities

Before a bank of any kind with capital stock can be organized, those who propose to organize it must first ascertain whether they can induce other parties to join with them in supplying the requisite amount of money for the purpose. All those who agree to do this are said to be "subscribers," and the first step to take, therefore, is to open a "list" of subscriptions, wherein the subscribers, by signing their names, agree to take a certain number of "shares," each share representing $100, or a smaller or greater amount, as fixed by law, and to pay in the money for same at or before a date named in the agreement, either in one amount or in several amounts called "instalments." With National banks the law requires that at least one-half of the capital must be paid in before the bank begins business, and that the remainder must be paid in five equal instalments monthly thereafter, or one-tenth monthly until the whole is paid in. All payments of capital stock should be made in actual money or the equivalent of ready money, and no promises to pay money at some future time should be accepted for this purpose. For each instalment paid, the subscriber should receive a proper voucher, or temporary receipt, stating the amount, the date of payment, and that it is the first, second, or other instalment paid. At the same time a book should be kept by the person or persons receiving these payments, which will clearly show in an account with each subscriber the same data as is shown by his receipts.

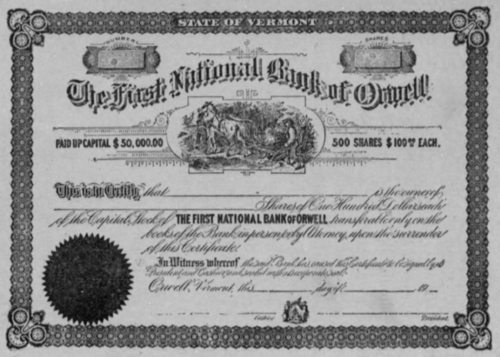

After the bank is authorized by law to commence business and all instalments have been paid in, the subscriber should then surrender his temporary receipts, and in the place of those receive from the bank his "certificate of stock."

The following is the usual form for a certificate of stock in a National bank, and the "stub" to which it is attached, which may be adapted, by changing the name. or "title" of the bank to the case of any State bank, stock savings bank, or loan and trust company:

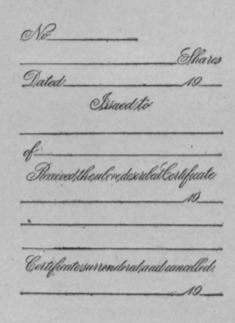

These certificates and their "stubs" should always he printed in hook form, and before the certificate is detached from the stub and surrendered to the shareholder, the proper memoranda should be made on the stub, and the shareholder should sign same as evidence that he received the certificate or authorize some person to sign for him. Both certificates and stubs should be numbered alike, from 1 upward, sequentially, so that each certificate will have a different and special number.

The certificates should be signed by two officers of the bank authorized by the directors to do so, usually the president and the cashier. In some cases a clause printed on the face of the certificate requires that the certificate, after being signed by the proper officers, shall, before being issued to the owner, be registered by some other corporation selected for the purpose, and countersigned by one of its officers. This is intended to prevent any improper or dishonest issue of stock.

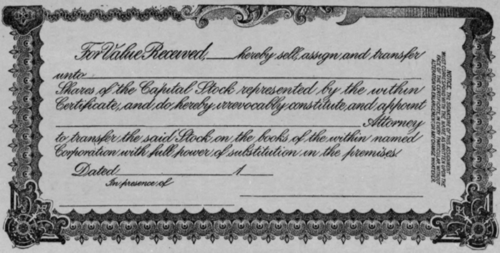

After a certificate has been issued in proper form to a shareholder, it represents "personal" property owned by him, but as it stands in his name on the certificate and on the books of the bank, he must, if he wishes to sell it or otherwise dispose of it, "transfer" it to the new purchaser or owner by "assignment" on the back, in the following form, which he must sign in the presence of a witness:

After the certificate has been properly assigned by the former owner, it should be taken or sent to the bank and surrendered, and a new certificate, showing the name of the new owner, issued in its stead. Unless this is done, the bank can have no knowledge as to what persons are the actual owners of its stock and entitled to receive dividends thereon, or are liable to be assessed to make good any impairment of the capital by losses, in cases where the law attaches such liability to the shareholders, as to those in National banks.

When a certificate is surrendered it should be so mutilated or "cancelled" as to prevent its improper reissue, and should be gummed to the stub from which it was originally torn, as evidence that it is no longer outstanding.

Usually a meeting of shareholders is held once a year, for the purpose of electing directors and transacting other business, and on special occasions to vote upon such questions as an increase or a reduction of capital or of closing up the business of the bank, which is called placing its affairs in "voluntary liquidation."

As a shareholder frequently lives at such a distance from the bank as to make it inconvenient to attend meetings in person, he should in such cases select some person who will attend in person to represent him and cast his vote as he may instruct, and such a representative is called a proxy. In the case of National banks, no director, officer, clerk, teller or bookkeeper of the bank is permitted by law to act as proxy. The appointment of a proxy is usually made in the following form:

This form of proxy may give power to vote at any and all meetings of shareholders, or be amended so as to limit

Proxy

John WarD, Manufacturing Stationer, 25, John street, N.Y.

do hereby constitute and appoint.....................................................................................................................................................

Attorney and Agent for and in name place and stead, to vote as proxy at...........................................................................of the...............................................................................................................

.........................................................................................................................................................................................

........................................................................................................................................................................................

according to the number of votes I should be entitled to cast if then personally present.

In Witness Whereof I have hereunto set my hand and seal this..............................................................day of...................................................one thousand..........hundred...............................................

Sealed and delibered in the presence of

........................

the power to a particular, meeting, to vote on a specified question.

Every shareholder is entitled to receive due notice, either by public advertisement in a local newspaper, or by mail, of any special meeting to vote on any such question as an increase or a reduction of the capital stock or voluntary liquidation, and where the law creating a bank does not specially prescribe this, the shareholder is usually entitled to receive such notice 30 days before the meeting is held.

To determine questions at such special meetings a vote of two-thirds the entire capital stock or number of shares is usually necessary, while in voting for directors, or to amend the articles of association or rules governing the general conduct of the bank's affairs, a majority, or one more share than half the capital stock, is required.

Where the law imposes additional liability upon shareholders and requires them to make good any "impairment" of capital stock caused by losses sustained on loans or other investments, or through the dishonesty of officers or employes, the National or State official charged with the administration of the law under which the bank is organized usually notifies the managing officers of the amount to be made good and the time within which the assessment must be paid in, and the officers, in turn, send out a written or printed notice to each shareholder, notifying him that an assessment has been made and that he must pay into the bank the amount of money representing his proportion within a stated time.

National bank shareholders are allowed three months' time, after receiving notice of assessment, within which to pay it. The payment of such an assessment is voluntary with each shareholder unless a majority of the whole capital stock decides to pay, in which case the stock of any share-holder unwilling or unable to pay at the end of three months after receiving notice may be advertised for sale by the directors for a month, and sold at auction, at the end of that time, for an amount not less than the amount of the assess-ment. In such a case, title to the stock goes to the new purchaser, the former owner being entitled only to any excess over the assessment his stock may fetch at the sale.

In case a bank fails and an assessment has to be made to help pay its debts, such an assessment is compulsory on the shareholder, and is a legal claim against his estate in ease he refuses to pay it voluntarily.

The minimum limit of capital stock required of National banks is based on population, as follows : $25,000 in places with population not exceeding 3,000 persons.

$50,000 in places with population not exceeding 6,000 persons.

$100,000 in places with population not exceeding 50,000 persons.

$200,000 in places with population exceeding 50,000 persons.

As to State banks, the capital required is fixed by the laws in each State. In some States banks can be organized with as little capital stock as $5,000.

Anyone desiring to organize a National Bank can obtain full information and instructions free upon application to the Comptroller of the Currency at Washington, D. C. Information as to the organization of State banks, savings banks, or loan and trust companies can also be had from the banking department of the State in which it is to be located, on application addressed to the capital of the State.

The officers of a National bank are required to keep a correct list of the shareholders of the bank, showing the address of each shareholder and the number of shares standing in his name, and this list is "subject to inspection by any shareholder or creditor of the bank at any time during business hours of any business day.

Continue to: