Enterprise. Continued

Description

This section is from the "Economics In Two Volumes: Volume I. Economic Principles" book, by Frank A. Fetter. Also available from Amazon: Economic

Enterprise. Continued

§ 4. The residual share. From the moment the first apprentice was hired or the first dollar was borrowed, the business became the source of a contractual income to some one, and, at last, of many contractual incomes, besides the one non-contractual income of the active enterpriser. These contractual incomes have the familiar price-names of wages (and in special cases, salaries), rents, and interest. The non-contractual income let us call profits, postponing for a time the more exact definition of the term. Before the owner can count his profits at the end of the year he must pay the agreed price of services and usances, wages to his apprentices, workmen, salesmen, bookkeepers, foremen, designers, etc., rent to the owner of the building or of hired machinery, interest to the lender of money or to the seller of lumber, supplies, etc. The contractual incomes of these other persons are prices, expressed in money-terms and paid by the enterpriser; his noncontractual income is what money and other goods he has taken out for his own use in that period, plus the net capital remaining that has accrued within the year. In the rare case where the business is bought at the beginning of the year, and is sold at the end, at a definite price, the difference (plus the amount meantime taken out) would exactly express the money income. But in a growing business the active capitalist's income can only be estimated, by taking careful invoices of all property at the beginning and at the end of the year, making allowances for needed repairs and for depreciation, counting outstanding debts and credits, amounts taken out for the owner's use, etc., and finding the resulting net excess of capital-value at the end of the year. This balance, if there be any, is the composite income of the owner, who is at the same time manager, and it contains whatever is to be attributed to his own services and to his invested capital of whatever sort. Viewing all the incomes in a legal light, this is the one residual income - it is what remains to the owner after paying all claims against the business. As a matter of bookkeeping also this is the one residual income, being the arithmetic remainder after subtracting from the total value of the products added in the course of the year to the capital, the total outlay (attributable to that year) which includes all of the contractual incomes due.1

1 It must not be thought, however, that viewed as a value-problem, as a question of logic, this share is a mere residual. That is, it must not be thought that all the other contractual shares (wages, rents, etc.) are determined prior to, and independent of, this share of the active capitalist, who takes what is left without having had any choice in the matter. That would be so if he could do nothing whatever about readjusting and rearranging his investments. The various contractual incomes are determined in an economic equilibrium of which the prospect of active capitalists getting a more or less definitely estimated minimum return is an essential part. The expectation of income has guided the enterpriser's choice of a business just as it guides the laborers (see ch. 18, sec. 3). For this particular year and business

§ 5. The typical owner-manager. This union of the function of business manager with that of active investor was at one time well-nigh universal, and it is still common in smaller enterprises. As applied to a small business this organization has the advantage of uniting in one person the one who is most concerned as to the financial outcome and the one whose judgment, energy, and care most largely determines the result. It unites responsibility and power. This plan still obtains generally in agriculture. In the United States in 1910 there were 6,300,000 farms of which 62 per cent were cultivated by the owners, 1 per cent by managers, and 37 per cent by tenants (which implies nearly always a large measure of oversight by the owner). A large proportion of the smaller factories are run in this way by an owner who started the business, or who has succeeded his father, or who, beginning as an apprentice, has advanced step by step in an older factory, getting first a share, and at last becoming head of the establishment. This plan prevails also in the great majority of retail stores and in many wholesale stores. A boy, going into a store, works up to a clerkship, and winning promotion step by step, gets a larger and larger share of the ownership and becomes the chief executive in the business.

§ 6. Empirical methods of estimating and apportioning the residual share. While management and ownership are thus united in one person or in one family, the attributing of the shares due to the personal labors of the management and to the investment is very imperfectly done. Indeed in a small business no effort is made to do so except in a vague and incidental way. (See Chapter 18, section 10.) The simple furniture-maker chose his trade primarily because of the labor-income it would yield-tho the need of tools and some investment in materials enters in some measure into the decision, as a burden (cost) incident to the trade, keeping some men out, and causing others to drop out when they can not keep up their equipment. But when the capital investment in shop, tools, materials, and stock is considerable, it comes to be estimated by comparison with alternative contractual incomes. A shopkeeper who clears $1000 in the year, seeing that he could sell out for $4000 and lend the sum for 5 per cent, counts "a fair return" on his investment as approximately $200 and his services at $800 a year; or having reason to think that he could not get a position working for an employer that would give him more than $700, counts his capital-income as $300, or 71/2 per cent; or having an offer of a good permanent position at $900, counts that he is making but $100 on his capital, which is but 21/2 per cent of what some one will pay him for it. Even in this case, either the greater independence of being his own master or the prospect of better business may deter him from making the change. It is well known that many small owner-managers both in handicrafts and in agriculture make no more, or even less, than "hired man's wages." this kind of share is an arithmetic residual, but year in and year out it is as much subject to adjustment by investors' valuations as is any other share. (Of this, more below, under cost of production, p. 34G ff.)

§ 7. Utmost possible degree of separation of investment and management. In the case of a growing business (such as that of the furniture-maker, section 3), as the owner-manager transfers one duty after another to an employee, the wage (or salary) paid becomes a part of the definite costs of the business. If his own labor is freed for more important things his final residuum will be greater. He can, however, transfer one duty after another to others without taking upon himself other tasks. Taking now the case of one who is already the owner of an establishment, consider what is the farthest point to which it would be possible to carry this differentiation of ownership (investment) and management. It can go to the point where the only task of management remaining to the owner is the appointment (and removal) of the general manager, all other matters being left to the appointee.

§ 8. Corporations and their control. Rarely when there is a single owner does he so completely divest himself of the managing function. But ownership and management are more nearly and more often separated when the organization is that of a stock company, or corporation, the ownership of which is divided among the holders of shares of stock, or certificates of membership. Many corporations have been organized by the successful single owner (or by partners, or by a family) as a method of enlarging the business, or of selling all or part of it, when the owner wished to retire, or to reduce his responsibilities with advancing years or with failing health. It is often difficult to find one buyer willing to invest the capital needed to acquire a large established business, whereas many persons are ready each to put in small sums if there is outlook for good returns. They are especially attracted either to an established business having reputation ("good will") and a record of yielding good incomes, or to a new business in which the prime movers and investors are men of known ability and success.

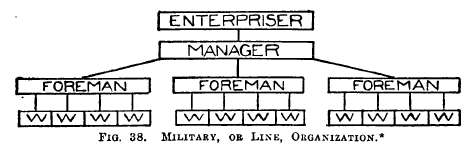

* The separation of enterprise and management may be seen in this simple type of organization. The enterpriser (a person or group of persons) selects the manager, who in turn appoints his subordinates. Each person in the organization receives directions from one immediate superior.

Advantage is taken of this fact by active business men, in fair and in unfair ways, and throughout the nineteenth century the corporate organization proved to be best fitted to attract large amounts of capital for the great industrial, mercantile, and transportation enterprises. Usually these corporations were organized by and around some one man or group of men, who either actually paid for stock, or issued it to themselves in payment for the promotion of the undertaking, retaining thus a majority of the voting power for themselves (each share having one vote). One share over half is the utmost needed for "control," and when the holdings are scattered in small amounts among stockholders, a very much smaller proportion is enough - sometimes as little as 5 per cent. The control may give the power to one man to elect himself to be president or general manager with power to fix his own salary and to appoint the other employees, and to control much in the way he could if absolute owner.

The capital-income from the stock he owns may be of slight importance to him compared with the control. There have been many ways in which the control of an industrial or transportation corporation gave opportunities, increasing with the size of the enterprise, for the man in control and his friends, to get large additional incomes. Many of these ways were plainly illegal, others unquestionably unfair, and still others in the debatable border zone of morality. These make up a large part of the so-called "corporation problem." It is not the place here to discuss that; we wish merely to show the nature of the incomes arising under corporate organization.

§ 9. Single investment function of minority stockholders. A minority stockholder who practically has no option but to vote for the officers nominated by the group in control, has in investing but one decision to make: whether to risk his capital in that enterprise managed by that group of men. The only corporations that attract large numbers of minority stockholders are such as for a number of years have paid regular dividends, have followed a pretty definite, well-understood policy, and have in large measure gained and deserved confidence. The Pennsylvania and the New York Central may be named as examples among railroads, whereas the New Haven, which up to about 1910 was in the same class, showed how swift and how great may be the losses inflicted upon minority stockholders as a result of a change of policy by those in control.

The minority stockholder, while he may have no voice practically in electing the management, nevertheless in his investment bears his full share of the risk of financial loss (indeed, he bears even more than his due fractional share of risk). The stockholders collectively make the initial investment, that which bears the main burden of the financial risk (not all, for the other contractual income-receivers are not absolutely secure), and they receive their non-contractual income as a legally residual share after all other outlays have been made.

Thus it appears from the foregoing survey that the peculiar function of enterprise is investment and ownership. In many cases still to-day, the functions of enterprise and of management are united in one person, who thus obtains an income that is a complex of an investment profit and a labor-income. In other cases, however, the management function is delegated to an employee, the hired manager, in which case the enterprise and the management functions are more clearly distinct because exercised by different persons. It is our task next to study more closely the function of management.

Continue to: