How To Keep Accounts. Part 3

Description

This section is from the book "Getting Your Money's Worth. A Book On Expenditure", by Isabel Ely Lord. Also available from Amazon: Getting Your Money's Worth: A Book On Expenditure.

How To Keep Accounts. Part 3

Nov.-Dec. (Single) Newspapers .42 Feb.-April Shoes polished .60

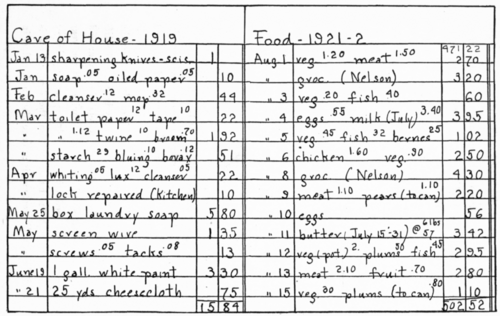

Copy of an actual card kept by a woman. The 1918 (wartime) expenditure was only the $3 recorded. The card shows the method of writing subheads and also the use of one card for several years. The other side will record two or three years more.

When a column is filled, the addition should be made at once and the total written in at the head of the next column. In this way the totals are never far behind. When one side of the card is used, turn and use the other, writing in the heading as at first. When a second card becomes necessary, it is better to put after the year another dash and the figure 2 - or 3, for a third card. For example:

Food-Fruit - 1922 - 2

When one card is filled and the total transferred to the top of the first column of the next, put the filled card (alphabetically) into a file at the back, with a guide in front marked Used Cards. It is convenient to fasten these together with a large clip or strong rubber band, so that there is no danger of other cards being mixed in. After a year or two there will be a considerable cumulation of these cards, but the alphabetic arrangement (and under the alphabet a chronological order) will enable one to look up a back item quickly.

At the end of the year add the total of each card, and in the case of a heading with subheads, the totals of all these, on one of the cards that has space enough for this. Clothing-Accessories is a good one to use for Clothing. If a year's entries fill only half the card or less, the card should be used for the next year also, the year and (if necessary) the budget allowance being written at the beginning of the account. A card such as Clothing-Jewelry should last any one several years. The use of the cards in this way not only economizes in cards and storage space, but facilitates comparison between year and year.

When all the cards are totaled, write into the space left for the purpose on the Budget card, opposite each heading, and next the sum assigned it, the actual expenditure. Total the columns and compare the Budget total with the Accounts total. Have regard to Savings in doing this, since if this shows any deficit, the result is not right even if the totals are evenly balanced. The card is now the Budget-Summary card for that year. The budget for the next year is of course made tentatively before the accounts for the current year can be closed, but the Budget-Summary card should be studied carefully to see whether it is in any way a stimulus to revision of the tentative budget. It is well not to write the new Budget card - or perhaps to leave some items in pencil - until the Budget-Summary card can be studied a little.

The Assets card comes next, and is easily made on the basis of the one with which the family began. The difference between the total of the Assets of one year and that of the next should equal the Savings of the year (including the reduction of debt) plus any larger amount of cash on hand. When the comparison is made here, a discrepancy is at once discerned, unless in

Care of House shows type of entry and compactness.

Food shows a second card for the year, with only brief entries; no analysis of kinds of food material kept in this record.

the rare case where the account keeper has balanced accurately and without relapse. The difference is the amount of money unaccounted for, dealt with earlier in the chapter. If Savings have had their due share, this deficit is not important, and could fairly be assigned to one or two or three of the larger headings. If the deficit is more than 1% of the income, as has been pointed out before, the accountant will be wise to establish or continue the habit of a weekly balance, even if Savings has not suffered. Otherwise one or more of the budget items may be getting an undue share of the sum not accounted for.

When the accounts are made up, the full cards, or those that obviously would not last through a second year, should be filed with Used Cards, and new cards for the current year written at once.

A file of receipts is part of any system of accounts. As is said in Chapter XIV if a bill is paid by check the returned check is sufficient receipt. All other receipts are conveniently kept alphabetically by the name of the creditor and those of one year together, so that after the number of years during which debt is collectible, they may be destroyed without examination, as in the case of bank checks.

A practical help in keeping watch of accounts due is a monthly slip list of payments to be met during the month. One form is made by clipping together three slips of paper. The top one is about an inch wide and two or three inches long. On it are written near the right margin the headings of the regular monthly payments - for example, Rent, House, Fuel, Service, Telephone. This is clipped to a slip about three inches square. At the top of this is written the date: Sept. 1, 1922. Opposite each heading is the amount that month will call for. On the right are written any special charges due that month, such as Dentist, Fire Insurance. The third slip is about three by five, so that when the three are clipped together it projects two inches below the others, and on this are payments due some time ahead, such as

Oct. | 1 | Life Insurance |

Oct. | 15 | Hospital pledge |

Nov. | 20 | Interest R. K. |

This third slip does not need to be changed monthly, and the top slip only when it grows soiled. If these are put into a letter clip, unpaid bills can be slipped in behind them, and other possible causes of expenditure, such as the appeal to contribute to a relief fund. Obligations that must be met in the near future can thus be easily checked.

Any person keeping accounts will make some variations from the procedure as outlined here, or from any procedure set forth by another person. But this particular routine is the result of years of experience, and of the experience of many individuals. If it is observed carefully at first, many a pitfall will be avoided, and the practice of it will give judgment as to the adjustment the individual may wish to make. The procedure is certainly not perfect, and any one may hope to improve it, but it is practical and effectual as it stands.

Continue to: