A Banker's Hints

Description

This section is from the book "Banking, Credits And Finance", by Thomas Herbert Russell. Also available from Amazon: Banking, credit and finance (Standard business).

A Banker's Hints

Do not draw a check unless you have the money on deposit or in your possession to deposit.

Do not test the generosity of your bank by presenting, or allowing to be presented, your check for a larger sum than your balance.

Do not draw a check and send it to a person out of the city expecting to make good the amount before it gets back.

Do not give your check to a friend with the condition that he is not to use it until a certain time.

Do not send ignorant and stupid messengers to the bank to transact your business.

Check Indorsements. In indorsing checks note the following points:

1. Write across the back - not lengthwise.

2. If your indorsement is the first, write it an inch or two from the top of the back; if it is not the first indorsement write immediately under the last indorsement.

3. Don't indorse wrong end up; the top of the back is the left end of the face.

4. Write your name as you are accustomed to write it, no matter how it is written on the face. There is a modern tendency to make the indorsement agree in all respects with the name of the payee as written on the face, but the practice of changing one's signature to conform with the whim, the carelessness or the error of another, is not to be recommended.

5. If you are depositing the check write or stamp "For Deposit" over your signature. This is hardly necessary if you are taking the check yourself to the bank. A check with a simple or blank indorsement on the back is payable to bearer, and if lost, the finder might succeed in collecting it, but if the words "For deposit" appear over the name, the bank officials understand that the check is intended to be deposited, and they will not cash it.

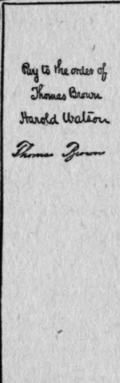

6. If you wish to make the check payable to some particular person by indorsing, write "Pay to......... (name)........or order," and under this write your own name as you are accustomed to sign it.

7. Do not carry around indorsed checks loosely. Such checks are payable to bearer, and may be collected by any one.

8. If you receive a check which has been transferred to you by a blank indorsement, and you wish to hold it a day or two, write over the indorsement the words "Pay to the order of.......... (yourself) .........."

This is allowable legally. The check cannot be collected until you indorse it.

9. An authorized stamped indorsement is as good as a written one. Whether such indorsements are accepted or not depends upon the regulations of the clearinghouse in the particular city in which they are offered for deposit. In New York City and Chicago the use of stamped indorsements is universal. The written indorsement is safer for transmission of out-of-town collections.

10. If you are indorsing for a company, or society, or corporation, write first the name of the company and then your own name followed by the word "Treas"

11. If you have power-of-attorney to indorse for some particular person, write his name followed by your own, followed by the word "Attorney" or "Atty" as it is usually written.

12. Where checks are sent out by the receiving (deposit) bank to all parts of the country for collection, it is customary for the bank to stamp upon the back of the check the words "indorsement guaranteed." Sometimes a check reaches a bank through responsible parties, who are not its payees, without bearing the payee's indorsement. The bank may decide to pay without demanding the absent indorsement, since such a demand would cause considerable delay and trouble, if the presenter or the presentee of the check guarantees the absence of the indorsement. This he does by writing "Absence of indorsement guaranteed," with his signature, on the back of the check. Of course, this is, practically a guarantee against loss and trouble to the banker, which might result from the absence of the indorsement. The banks of some cities will not accept such guarantee. It is sometimes permissible to indorse the payee's name "by.............. (your own name) .............."

This may be done by a junior member of a concern when the person authorized to indorse checks is absent, and the checks are deposited and not cashed. If a check lacks the indorsement of the original payee, it may be wise, if convenient to do so, to get it certified before sending it back for such indorsement.

13. Write your check payable to the order of some person, but don't write "Pay to the order of James Gordon Bennett, for subscription to Herald for 1912." Such information on a paid check may serve some purpose of yours, but it is not good business. Descriptive and qualifying matter is quite proper in the letter accompanying the check, and if the letter has been copied, it is just as legally valuable.

14. Do not write any unnecessary information on the back of your check. A story is told of a woman who received a check from her husband, and when cashing it wrote "Your loving wife" above her name on the back.

Continue to: